How Georgia hard money lenders Help Investors Close Deals in Record Time

Understanding the Conveniences and Dangers of Hard Money Loans genuine Estate Investors

Tough money car loans provide a special funding alternative genuine estate financiers. They use fast accessibility to funding with less restrictions compared to standard finances. Nevertheless, the attraction of speed includes significant risks, consisting of high-interest prices and rigorous settlement terms. Recognizing these characteristics is important for investors wanting to maximize urgent possibilities. Steering via the advantages and prospective pitfalls will determine whether hard money car loans are a wise selection for their investment method.

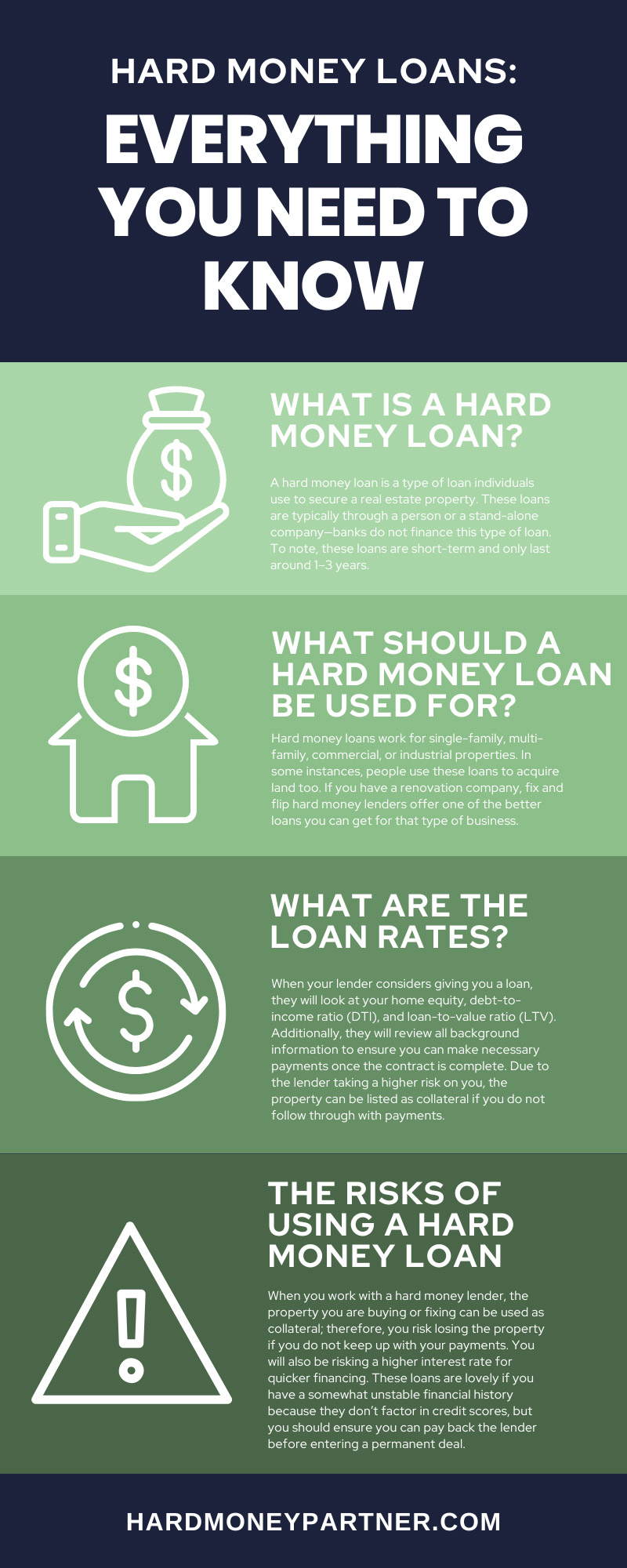

What Are Hard Cash Loans?

Hard cash lending institutions are typically exclusive individuals or firms instead than standard financial institutions, enabling them to run with more flexibility concerning underwriting requirements. Rates of interest on tough money financings have a tendency to be higher compared to traditional financing, showing the enhanced threat entailed. Georgia hard money lenders. Financiers frequently transform to these fundings when they need fast accessibility to funding for investing in, remodeling, or flipping homes. Understanding the nature of difficult money financings is essential for investors seeking to take advantage of opportunities in the actual estate market

Key Advantages of Hard Cash Loans

Difficult cash fundings offer a number of benefits that attract investor. These financings give fast accessibility to funds, making it possible for financiers to confiscate possibilities without lengthy authorization processes. Furthermore, adaptable borrowing standards and temporary funding services make them an eye-catching choice for different investment techniques.

Quick Access to Funds

Versatile Offering Standards

For genuine estate capitalists, versatile lending requirements stand for a significant benefit of hard cash lendings. Unlike conventional financing alternatives, which commonly rely greatly on credit report and considerable documents, difficult money loan providers concentrate primarily on the worth of the home being financed. This method permits capitalists with less-than-perfect credit rating or limited monetary history to protect financing, making it simpler to go after financial investment possibilities. Additionally, tough cash lenders might additionally think about the financier's experience and the residential or commercial property's possibility for recognition as opposed to solely evaluating economic metrics. This adaptability can quicken the finance authorization process, enabling investors to act rapidly in competitive realty markets. Such leniency in loaning standards is especially beneficial for those looking for to profit from time-sensitive bargains.

Temporary Financing Solutions

Real estate financiers frequently deal with time restraints, temporary financing services like tough cash finances provide a sensible option to fulfill instant financing demands - Georgia hard money lenders. These car loans are generally secured by the property itself, enabling investors to bypass prolonged conventional borrowing procedures. Authorization can often happen within days, making difficult cash lendings ideal for time-sensitive deals such as turning homes or closing on troubled buildings. The rate of financing makes it possible for investors to take advantage of rewarding chances that may otherwise be missed. Additionally, these lendings can be tailored to match certain project timelines, providing flexibility in settlement terms. Overall, difficult cash car loans act as a crucial device for capitalists seeking fast accessibility to resources in a competitive real estate market

Prospective Drawbacks of Hard Money Loans

While difficult cash fundings supply quick access to resources, they feature considerable disadvantages that financiers ought to take into consideration. Specifically, high rates of interest can lead to significant expenses gradually, while brief payment terms might pressure consumers to generate quick returns. These factors can influence the total expediency of making use of difficult cash financings genuine estate investments.

High Rates Of Interest

What variables add to the high rate of interest commonly associated with tough money lendings? Mainly, these prices show the threat profile read more that lenders carry out. Hard cash lendings are generally released by private capitalists or companies, which do not abide by standard banking regulations. Because of this, they often financing properties that traditional lending institutions might consider as well dangerous. Additionally, difficult cash financings are normally temporary remedies, necessitating higher interest rates to make up for the rapid turnaround. The rate of financing likewise adds; lending institutions bill much more for the benefit and quick accessibility to capital. Subsequently, while hard cash loans can be helpful for fast transactions, the high rates of interest can significantly affect overall investment returns, making mindful factor to consider vital for potential consumers.

Brief Payment Terms

High rate of interest are not the only concern for consumers taking into consideration difficult money fundings; brief settlement terms likewise present substantial obstacles. Commonly varying from a few months to a number of years, these terms can pressure consumers to create fast returns on their investments. This urgency might lead to hasty decision-making, resulting in less-than-optimal residential or commercial property acquisitions or inadequate renovations. Furthermore, the impending due date can create monetary pressure, as capitalists must either safeguard refinancing or offer the property within a limited duration. The threat of default rises under such conditions, possibly bring about loss of the collateral. While difficult cash fundings use rapid access to funding, the brief repayment terms can complicate a financier's financial technique and general success.

When to Take Into Consideration Tough Cash Lendings

When is it prudent genuine estate financiers to ponder difficult cash car loans? When typical funding choices are impractical, such finances are often taken into consideration. Capitalists might seek hard money lendings for quick accessibility to funding, particularly in affordable realty markets where timely offers are vital. They are specifically beneficial in circumstances involving distressed buildings, where urgent remodellings are needed to enhance value. Furthermore, when a financier's credit report is less than perfect, difficult cash finances give a different route to financing. Capitalists may additionally discover these finances valuable for obtaining homes at public auctions, where instant funding is needed. Moreover, for those seeking to utilize short-term investments or fix-and-flip chances, hard cash loans can assist in quick deals. Inevitably, the decision to utilize difficult money loans should be directed by the specific investment strategy and time-sensitive needs of the investor.

Just how to Choose the Right Hard Money Loan Provider

Choosing the right difficult money lending institution is essential genuine estate investors that make a decision to pursue this funding alternative. Capitalists need to start by investigating lending institutions' online reputations and evaluations to guarantee reliability. It is essential to validate the loan provider's experience in the genuine estate market, especially in the details type of financial investment being targeted. Analyzing funding terms, including rates of interest, charges, and settlement routines, permits investors to contrast deals effectively. Transparency in communication is vital; a great lending institution must conveniently respond to concerns and supply clear explanations of the funding procedure. In addition, evaluating the lending institution's funding speed can influence financial investment possibilities, as prompt access to resources is usually essential. Constructing a relationship with a lending institution can assist in future transactions, making it valuable to choose a loan provider that is not just professional however additionally recognizes the financier's requirements and objectives.

Requirements Approaches for Effective Hard Money Car Loan Financial Investment

Effectively steering hard cash car loan investments needs a critical strategy that maximizes returns while decreasing threats. Investors ought to start by performing thorough marketing research, determining locations with solid development potential and targeting residential properties that can generate high returns. Establishing a clear exit technique is essential, whether with property resale or refinancing.

Furthermore, preserving a strong relationship with credible tough cash lending institutions can help with smoother transactions and better terms. Capitalists must also perform persistent due persistance on buildings, reviewing their condition and possible repair expenses to avoid unanticipated expenditures.

Connecting with experienced investors can supply insights into successful financial investment methods and pitfalls to prevent. Lastly, a mindful analysis of the funding's terms, including rates of interest and repayment schedules, is necessary to ensure the investment continues to be rewarding. By executing these strategies, capitalists can navigate the complexities of tough money finances effectively and enhance their general success in actual estate investing.

Frequently Asked Inquiries

What Kinds Of Feature Get Hard Cash Loans?

Tough money lendings normally qualify properties that call for fast financing, such as fix-and-flips, industrial structures, and investment homes. Lenders mainly think about the building's value as opposed to the debtor's credit reliability or revenue.

How Swiftly Can I Obtain Funds From a Hard Cash Lender?

The speed of receiving funds from a difficult money lending institution commonly ranges from a couple of days to a week. Georgia hard money lenders. Variables affecting this duration include residential property appraisal, documents efficiency, and the loan provider's operational performance

Are Tough Cash Fundings Readily Available for Non-Investment Quality?

Hard money financings are mainly developed for financial investment buildings, but some loan providers may think about non-investment residential or commercial properties under particular conditions. Borrowers need to ask directly with loan providers to comprehend details eligibility needs and conditions.

What Costs Are Usually Connected With Difficult Cash Lendings?

Difficult cash loans normally include different costs, consisting of source charges, evaluation costs, shutting costs, and in some cases prepayment charges. These charges can considerably affect the overall expense, requiring cautious factor to consider by prospective debtors.

Can I Refinance a Difficult Money Lending In The Future?

The possibility of re-financing a hard cash financing exists, typically contingent on the residential or commercial property's appreciation and customer certifications. This process might assist in lower rate of interest or better terms, boosting economic flexibility for the capitalist.

Difficult cash car loans offer an unique funding choice for actual estate investors. Tough cash financings are specialized financing choices primarily made use of by genuine estate capitalists. Securing fast accessibility to funds is a primary benefit for genuine estate financiers looking for tough cash lendings. Genuine estate capitalists often face time restraints, short-term financing remedies like tough money lendings provide a practical option to satisfy prompt financing requirements. Capitalists could look for hard cash car loans for quick accessibility to resources, specifically in affordable actual estate markets where timely offers are crucial.